Immediately (and refreshingly) it was apparent that Nick had OUR interests at heart rather than HIS. There was never any sales pitch whatsoever in order to flog us a policy or migrate to his company from our current one/s – he was actually very professional, courteous and respectful of ANY other company that we were involved with.

Welcome To Sustainable Wealth

You’re here because you understand money isn’t just about numbers – it’s about choices that reflect what matters to you.

We share something important: the desire to have a positive impact while building financial security, and the satisfaction of knowing our money works for causes we believe in.

But here’s something I’ve discovered in my work with values-driven individuals…

There’s often a disconnect between our personal values and our investment choices.

Sustainable Wealth

The Challenge Many People Face

While you’ve worked hard to live according to your values, there’s often a gap when it comes to your personal wealth and financial planning.

You care about sustainability, social responsibility, and making a positive impact. But when did you last check if your personal wealth and investments actually reflect those same core values?

Here’s what really concerns me: Your pensions and investments may be unknowingly exposed to industries and sectors which openly conflict with the very values you stand for. Are your investments aligned with your values ![]() whilst seeking a sustainable financial return

whilst seeking a sustainable financial return ![]() aligned with your priorities and risk tolerance?

aligned with your priorities and risk tolerance?

The uncomfortable truth: Some “sustainable” investment options may be wolves in sheep’s clothing with a green label slapped on. You may be paying a premium for investments that aren’t truly aligned with your values.

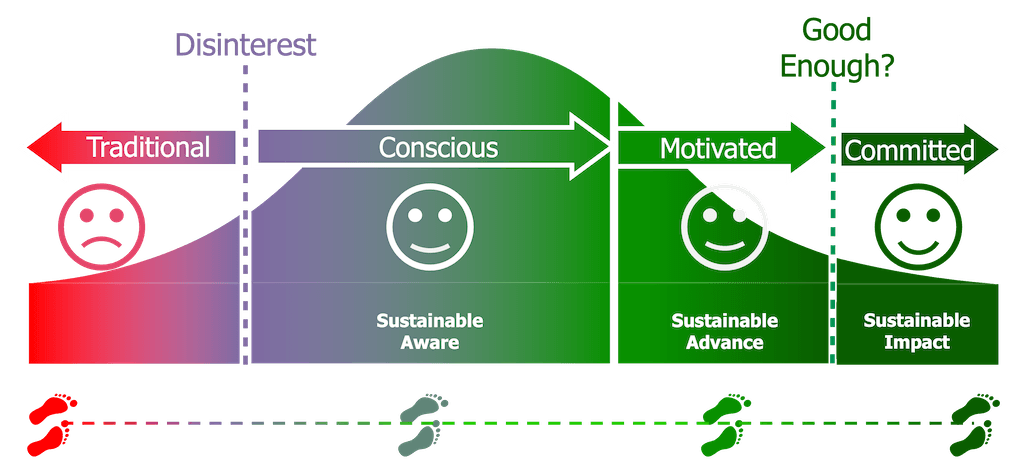

When we think about value alignment, we first ask “Where do you sit on the Sustainable Investment Spectrum?”

I'm Nick Smith - Your B Corp Sustainable Wealth Partner

Why Me?

![]() B-Corp Certified (I walk the walk, I don’t just talk)

B-Corp Certified (I walk the walk, I don’t just talk)

![]() Ex-Naval Aviator

Ex-Naval Aviator ![]() (I understand risk and critical decision-making)

(I understand risk and critical decision-making)

![]() Sustainable Wealth Framework™

Sustainable Wealth Framework™ ![]() (Proprietary methodology focusing on outcomes, not products)

(Proprietary methodology focusing on outcomes, not products)

![]() Proven Track Record (Helping clients achieve Financial Longevity, lead a Richer Lifestyle, and leave an Enduring Legacy)

Proven Track Record (Helping clients achieve Financial Longevity, lead a Richer Lifestyle, and leave an Enduring Legacy)

I work exclusively with committed individuals and business owners who want their wealth to reflect their values.

How The Sustainable Wealth Framework™ Actually Works

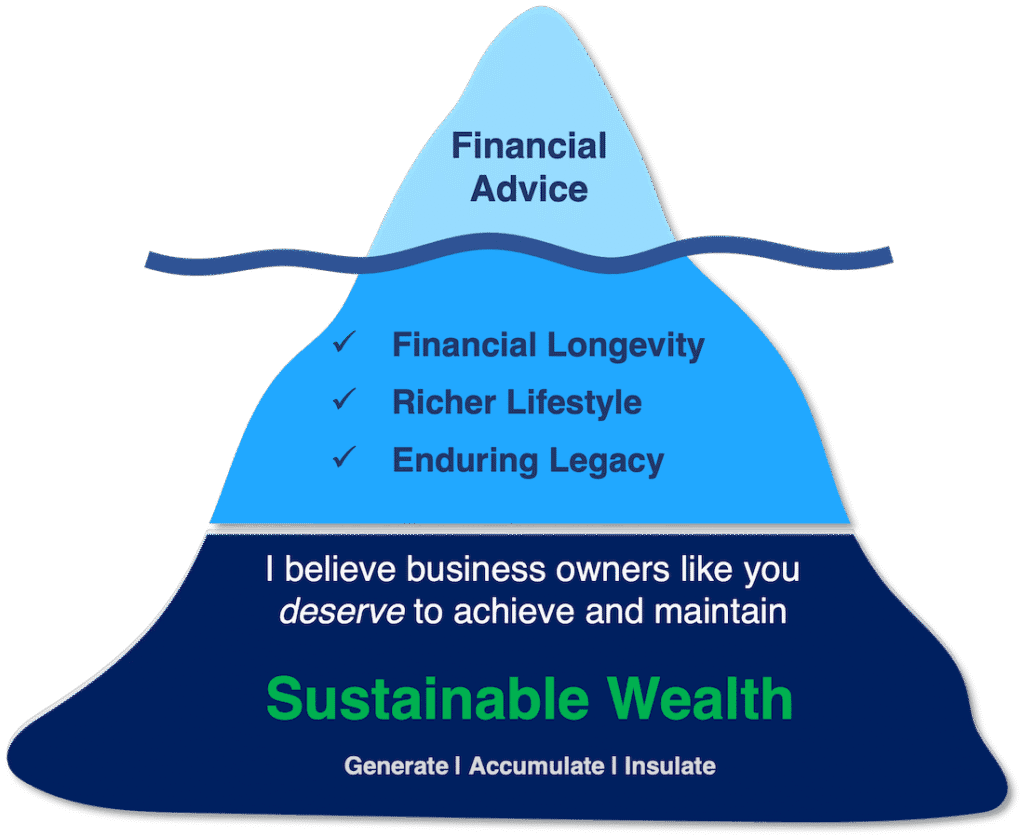

Yes, some financial advisors work at the tip of the iceberg – the bit you can see above water.

They talk about products: pensions, ISAs, investments. It’s shallow and product-led.

I work differently.

Think of financial advice like an iceberg with three layers. Rather than stay at the surface, I dive much deeper to find where the real Sustainable Wealth happens.

Like a coconut, the real value is deep inside. I don’t focus on the outer shell – the products – I focus on what’s valuable inside: the outcomes you actually want to achieve.

The Three Outcomes That Matter

Nobody lies awake thinking about pensions and ISAs (well, maybe I do!). You’re more likely worrying about three fundamental questions:

- “What happens if I live too long?” – Will I outlive my money?

- “How do I optimize my resources to enrich my life?” – Am I making the most of what I have?

- “How do I shift from success to significance?” – What legacy am I creating?

It's About Outcomes Not Products

Financial Longevity – You’ll make wise decisions with confidence and execute your plan for Sustainable Wealth.

A Richer Lifestyle – You’ll enrich the life you deserve while staying true to your sustainable values. You’ll lead a life worth living.

An Enduring Legacy – It’s not just your money, it’s your family and the environment too. You’ll ease from financial success to true significance.

(A nod to my regulated industry ![]() … clearly your outcome needs to be realistic and achievable within the constraints of your circumstances and risk tolerance. I get that you might want to solve world poverty with your legacy, but even Bill Gates is struggling with that one. So, achievement of your outcomes will depend on market conditions outside anyone’s control)

… clearly your outcome needs to be realistic and achievable within the constraints of your circumstances and risk tolerance. I get that you might want to solve world poverty with your legacy, but even Bill Gates is struggling with that one. So, achievement of your outcomes will depend on market conditions outside anyone’s control)

Here's How We Make It Happen

Generate Growth – You’ll move from vague to structured with a clear asset map and action plan aligned with your goals and objectives.

Accumulate Wealth – You’ll go from casual to measured with a structured growth plan and regular monitoring to help you stay on track.

Insulate Assets – You’ll move from vulnerable to secured by working to protect and shield your assets from financial threats. Like a coconut’s hard shell, we aim to create strong layers of protection around your wealth.

The result? Sustainable Wealth that truly reflects your values.

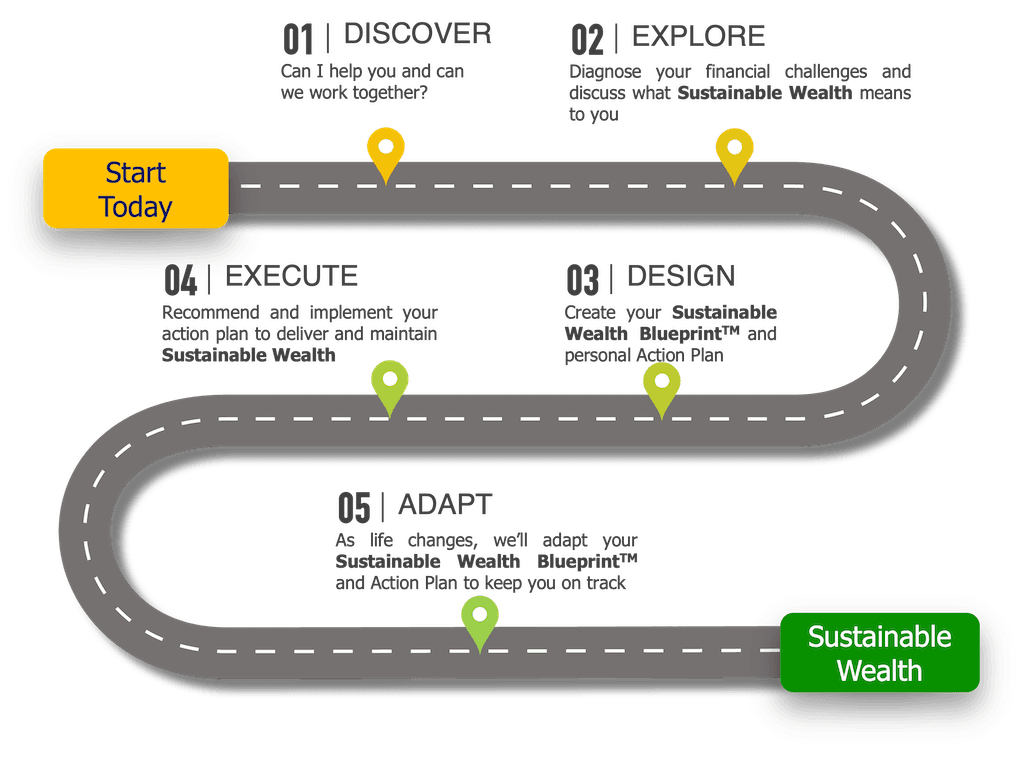

The Sustainable Wealth Roadmap™

Here’s how we work together to move from where you are now to true Sustainable Wealth:

*Stages 2 and 3 are what you’re investing in after our Get Cracking Call. This is unregulated financial planning – strategy, financial action plans, and blueprint creation, not regulated financial product recommendations.

The key point: You’re only committing to Stages 2 and 3 initially. The Execute and Adapt services are optional and only happen if it makes sense for both of us to move forward together.

What My Clients Say

Nick was the epitome of calm, friendly professionalism… his knowledge and insight were, and continue to be, invaluable to my family.

Well, how refreshing was this – I was actually interested, fascinated and engaged by Nick – his approach, his methodology, his explanations and knowledge coupled with obvious passion and desire to HELP US above all else. With clear, concise, and understandable explanations and suggestions, I found for the first time ever that this whole topic actually interested me and was an area that I wanted to know more about.

Nick is extremely professional, always well prepared, has a wealth of financial knowledge, and is an expert in his field. He has made us feel comfortable in our decisions and always takes the time and effort to explain all decisions clearly.

“The Sustainable piece at the centre is really good. I don’t think there’s enough people like you saying there is a way of managing wealth expectations and creating benefit from your success, and doing it in a sustainable way.”

I believe the key here is Nick’s understanding and knowledge base of pretty much every aspect of wealth management, highlighting beneficial areas tailored to us specifically, which we had previously been totally unaware of, with the emphasis on MANAGEMENT – Anyone can give the cliched ‘financial advice’, but actually managing an extensive and diverse portfolio geared specifically towards us and our future is where Nick excels.

Nick was knowledgeable, honest and clearly working in the best interest of his client. He was organised, professional and he always came back to me when he said he would.

Real Results:

– One client went from “I’ll work until I’m dead” to mortgage-free and retiring earlier than they ever imagined

– Another discovered their existing investments contradicted their business values – we aligned everything with their values while maintaining their financial objectives

– Multiple clients now sleep soundly knowing their wealth works FOR their values, not against them

(Another nod to my regulated industry … these are specific client experiences. It is not a guarantee of what all clients will experience given markets are outside anyone’s control. Past performance is not a guide to future returns)

"But What About...?" - Your Questions Answered

Q “Doesn’t sustainable investing mean lower returns?”

Not necessarily. It depends how sustainable you want to be. The more you move toward impact investing, the more investment risk you accept. But for most B Corp business owners, the majority of your investments can probably use exclusion-based strategies that avoid the worst players while maintaining diversification.

Q “This sounds expensive.”

My charges are transparent and reflect fair value for the work I do. If you’re lucky enough to have £1m to invest, my charges may reflect economies of scale. But if you want to invest that £1m in ten chunks of £100k, that’s ten times the work. You’re not paying for my time – you’re paying for my experience and expertise. (You can read my full Terms of Business including costs disclosure by clicking here. Before any regulated advice is ever given, you will receive a full, clear, and transparent breakdown of all costs including how those costs may impact returns)

Q “I don’t have time for complex planning.”

Planning is the foundation. If you don’t have a clear plan with clear goals and objectives, there’s no way to measure whether your financial action plan is delivering against those outcomes. Any plan is better than no plan at all. Most people put more time into planning their holidays than planning their financial future! What does that say about the importance of their future well-being?

Q “My current advisor already offers sustainable options.”

Do you trust them enough to get a second opinion? Some “sustainable” investment options may be wolves in sheep’s clothing with a green label slapped on. Have they actually looked at the percentage exposure you have to various industries? Has your advisor been through B Corp certification? Do they understand what it actually means? I have – because I’ve walked the walk, not just talked about it.

Q “I’ve had bad experiences with financial advisors.”

I get it. Every industry has bad apples. Many advisors focus on products, not outcomes. They use confusing jargon and sit on the opposite side of the table from their clients. I sit on the same side as you, working together to do the right thing at the right time to get you to the right place.

Q “What do we mean by ‘values-aligned / sustainable?”

We use ESG screening criteria, exclude certain sectors, consider positive impacts, and regularly monitor holdings. We use third-party data / independent benchmarks. We also recognise that what counts as “sustainable” may differ between clients; we tailor based on your personal values and objectives.

Q “What does it mean to be a B Corp?”

B Corps do not have a single written definition of “sustainable”; instead, they define it through a commitment to a triple bottom line, valuing people, planet, and profit equally, and ensuring that their products, practices, and profits do not harm but rather benefit all stakeholders. Sustainability for B Corps means integrating social and environmental goals into their core business strategy to achieve positive societal impact and build a more inclusive, regenerative, and sustainable economy.

Why Am I Telling You This Now?

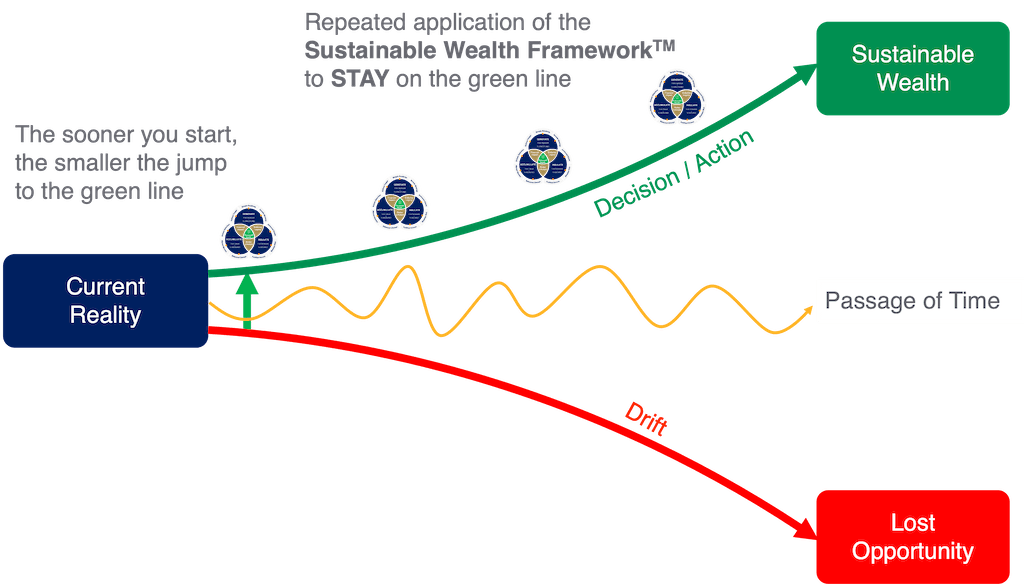

Because every day you delay, the gap between where you are now and achieving Sustainable Wealth gets wider.

The longer you leave it, the bigger the jump you’ll need to make to get your wealth aligned with your values while still meeting your financial goals.

Here’s the reality: I can only work with a handful of new clients each year. If you’re serious about aligning your wealth with your values, the best time to start was yesterday. The second best time is today.

Ready To Align Your Wealth With Your Values?

Here’s what happens next:

- Book your FREE Strategy Session to discover how to achieve and maintain Sustainable Wealth

- If I can help you, and we’re a good fit, we’ll get started on your journey

- If I can’t help you, I’ll point you in the right direction

No pressure, no sales pitch. If I can’t help you, I’ll tell you straight.

My Guarantee To You

If after our WhatsApp conversation and Discovery Call, we see I can’t help you, I’ll point you in the right direction for what you need next. No charge, no hard feelings.

I only work with clients I can genuinely help. If that’s not you, I’ll tell you straight.

The Gap Is Widening

Every day you delay makes the jump to Sustainable Wealth harder and more difficult to achieve.

Don’t let another month pass with your wealth working against your values. Send me a WhatsApp message and let’s have an honest conversation about aligning your investments with what’s important to you.

It takes 30 seconds. The Sustainable Wealth conversation lasts a lifetime.

P.S.Your wealth is either working for your values or against them. There’s no middle ground. Let’s make sure it’s working for you.

P.P.S A final nod to my regulated industry ![]() … All investments carry risk. The value of investments can fall as well as rise, and you may get back less than you pay in. Past performance is not a reliable indicator of future results. There is no guarantee your objectives will be achieved in the time frame you require given markets are outside anyone’s control.

… All investments carry risk. The value of investments can fall as well as rise, and you may get back less than you pay in. Past performance is not a reliable indicator of future results. There is no guarantee your objectives will be achieved in the time frame you require given markets are outside anyone’s control.